S-Oil to speed up push into chemical business

By Dec 21, 2020 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

S-Oil Corp., 63.4% owned by Saudi Aramco, will more than double its petrochemical production capacity over the next decade to further expand beyond the refinery business, which has been wrestling with tumbling oil demand and heightened environmental regulations.

Under its Vision 2030 plan announced on Dec. 20, the South Korean refinery will boost petrochemical products such as ethylene and propylene to 25% of its total output by 2030 from the current 12%.

The plan mirrors the move by domestic rival companies such as GS Caltex Corp. and Lotte Chemical Corp. into high-value petrochemical segments, while aligning with global efforts to reduce greenhouse gas emissions.

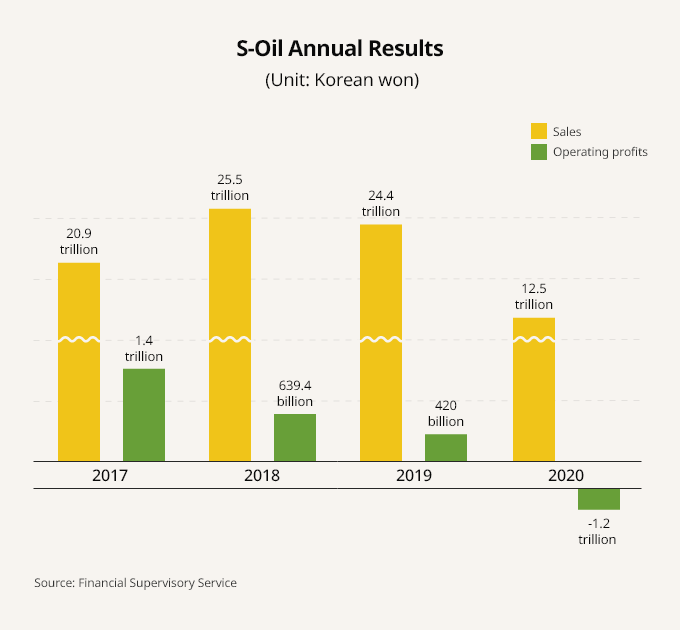

Despite heavy losses posted this year, S-Oil reaffirmed its plan to spend about 7 trillion won ($6.4 billion) to build a large-sale naphtha cracking center. At the facility to be constructed, it will produce basic petrochemicals such as ethylene and propylene, which are in turn used to make a wide range of products, including synthetic resins, synthetic rubber and medicine.

Naphtha, distilled from crude oil, is similar to gasoline and used as a petrochemical feedstock.

Last year, S-Oil began the operation of its first petrochemical plant in Ulsan, southeast of Seoul, for which it spent 5 trillion won. The facility uses low-value bunker C oil to produce ethylene and propylene, as well as polypropylene.

The efforts to diversify into the chemical industry reflect falling oil demand and a stricter regulatory environment that has increased environmental, social and governance (ESG) requirements.

S-Oil will also have its petrol stations across South Korea used as charging stations for electric vehicles and hydrogen-powered cars, in tandem with the government’s initiatives to facilitate the adoption of EVs and hydrogen fuel cell cars.

Given the lack of details in the announced Vision 2030, the company will soon unveil specific plans to enter the EV battery recycling and hydrogen fuel cell market, while considering building hydrogen charging stations in Seoul.

“This is more like a declaratory announcement. It will take time to specify our road map to achieve this vision,” said an S-Oil source.

Write to Jae-Jwang Ahn at ahnjk@hankyung.com

Yeonhee Kim edited this article.

-

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South Korea

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South Korea3 HOURS AGO

-

-

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India21 HOURS AGO

-

EarningsKakaoBank posts record Q1 profit, eyes Thai expansion after Indonesia

EarningsKakaoBank posts record Q1 profit, eyes Thai expansion after IndonesiaMay 08, 2025 (Gmt+09:00)

-

E-commerceCoupang’s Q1 revenue up; quarterly dip signals rising competition

E-commerceCoupang’s Q1 revenue up; quarterly dip signals rising competitionMay 07, 2025 (Gmt+09:00)