Economy

S.Korea’s July household debt grows at fastest pace in over 3 years

Higher housing prices in Seoul and the government’s inconsistent lending policy are fueling household borrowing

By Aug 01, 2024 (Gmt+09:00)

2

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

South Korea’s household debt is expanding at the fastest pace in over three years, clouding growth in Asia’s fourth-largest economy and keeping the Bank of Korea in a bind over the central bank’s next monetary move toward easing.

According to industry data on Thursday, the outstanding balance of household lending by Korea’s five commercial banks stood at 715.74 trillion won ($524 billion) at the end of July, up by 7.17 trillion won, or 1%, from 708.57 trillion won in the previous month.

That’s the biggest growth rate since April 2021, when household loans grew by 9.23 trillion won from a month earlier.

In March, Korea’s monthly household lending by five banks declined by 2.22 trillion won from the previous month, but has since increased every month through July.

Such loans grew by 4.43 trillion won in April, followed by an increase of 5.23 trillion won in May, 5.34 trillion won in June and 7.17 trillion won in July.

The five banks are Kookmin, Shinhan, Hana, Woori and Nonghyup, belonging to KB Financial Group, Shinhan Financial Group, Hana Financial Group, Woori Financial Group and Nonghyup Financial Group, respectively.

EXPECTATIONS OF HIGHER HOUSING PRICES

Analysts said the accelerating pace of household debt growth was fueled by expectations of higher housing prices, especially in the Seoul metropolitan area, and the government’s lack of tighter individual lending rules.

Last month’s household lending growth was boosted by a surge in demand for mortgage loans, which grew amid signs of a recovery in the property market.

The outstanding balance of mortgage loans at the five banks was 559.75 trillion won at the end of July, up by 7.6 trillion won, or 1.4%, from 552.15 trillion won at the end of June.

Apartment transactions in Seoul stood at 6,150 units at the end of June, up 18.7% from the previous month.

Apartment prices in the capital have risen for 19 consecutive weeks through the end of July.

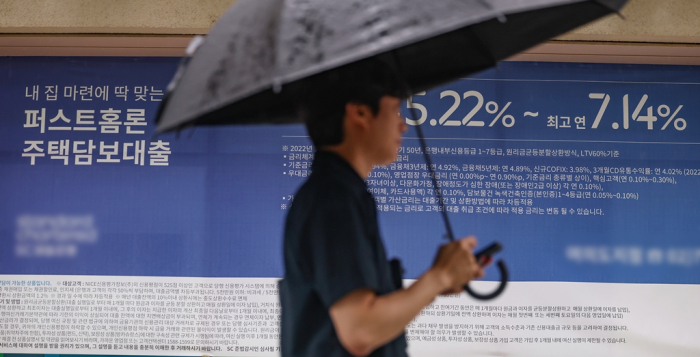

BANKS HIKE LENDING RATES

Domestic banks have raised their lending rates to curb growth in household debt.

Kookmin Bank raised its interest rates on mortgage loans and jeonse, or lease rates, four times last month.

Shinhan Bank increased mortgage and jeonse interest rates three times while Woori Bank hiked them twice last month.

Shinhan Bank said it will further increase its mortgage and jeonse interest rates by an additional 0.3 percentage point next week.

Critics said the government’s inconsistent lending policy contributed to the accelerating household debt growth.

The Financial Services Commission was slated to tighten lending regulations by implementing the stressed debt service ratio on July 1, but delayed it until Sept. 1 just one week before introducing the tighter rules.

Write to Eui-Jin Jeong at justjin@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EconomyKorea’s household debt growth at 5-month high on mortgages

EconomyKorea’s household debt growth at 5-month high on mortgagesMay 13, 2024 (Gmt+09:00)

2 Min read -

EconomyKorea’s household, business loans on upswing in September

EconomyKorea’s household, business loans on upswing in SeptemberOct 12, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK warns of household lending risk on growth, inequality

Central bankBOK warns of household lending risk on growth, inequalityJul 17, 2023 (Gmt+09:00)

3 Min read -

-

EconomyNew FSC chief nominee tough on household debt, against cryptocurrencies

EconomyNew FSC chief nominee tough on household debt, against cryptocurrenciesAug 06, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN