Yanolja gains momentum with cloud, overseas trip businesses

The S.Korean travel platform operator’s new growth drivers – cloud and overseas trip units – started generating profit

By May 24, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

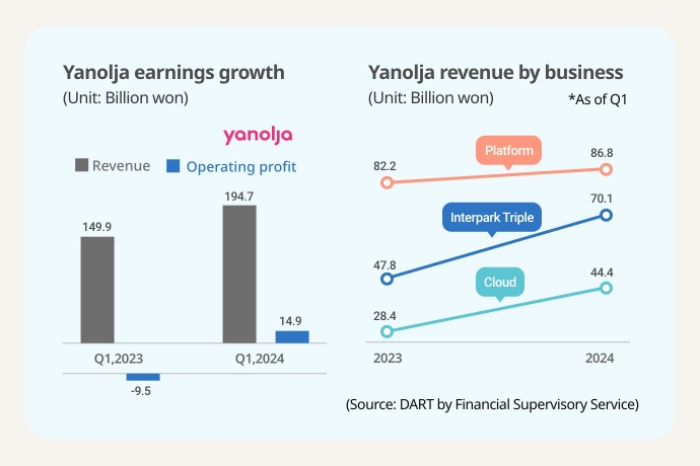

SoftBank-backed Yanolja Co. cheered stellar earnings in the first quarter after its new businesses – cloud and outbound trip services – more than offset the slowdown in local travel demand, giving a boost to its much-anticipated public listing.

According to the company’s regulatory filing, South Korea’s No. 1 travel and accommodation booking platform operator reported 194.7 billion won ($142.2 million) in operating profit in the January-March period of this year, up nearly 30% from the same period of last year.

Its top line also swung to a gain of 14.9 billion won from a 9.5 billion loss over the same period.

Its new growth drivers' solid performance is largely credited to the upbeat earnings results.

In the first three months of this year, the share of its mainstay travel platform business in its entire revenue dropped to 44.6% from 53.5% a year ago as overseas trip demand outstripped local trip demand in the endemic era.

Yanolja’s travel platform mainly focuses on domestic travel and accommodation services.

Over the same period, its new services gained traction, expanding their presence in the company.

Of Yanolja’s total revenue in the cited quarter, the share of its cloud business rose to 22.3% from 18.5% a year ago, while that of Interpark Triple added to 36.0% from 31.1%. The new businesses made up nearly 60% of the company’s total sales.

Cloud and Interpak Triple also started generating profits.

The cloud service returned to a profit of 9 billion won in the first quarter of this year from a loss of 4 billion won in the same period last year. This was the third straight quarterly profit for the cloud business after it reported its first gain in the third quarter of last year.

Interpark Triple also turned around to a profit of 1.5 billion won from a loss of 9.6 billion won.

DIVERSIFICATION EFFORTS PAY OFF

The latest results suggest that Yanolja’s new businesses have gained growth momentum, boding well for the SoftBank-backed Korean startup's initial public offering.

Founded in 2005, Yanolja has recently accelerated its hunt for new growth engines beyond its core local travel platform business under the direction of its founder and Chairman Lee Soo-jin.

In 2017, the Korean tourism platform unicorn forayed into the cloud market, betting on its business-to-business service that offers accommodation operators across the world hotel data collected by Yanolja from its travel platform operation.

Last year, it acquired Go Global Travel (GGT), an Israel-based company for global B2B travel solutions, through its subsidiary Yanolja Cloud in what was considered the largest acquisition in the startup’s history.

With GGT’s over a million pieces of tourism inventory distributed worldwide, including reservations for hotel rooms and resorts, airfare and car rentals, Yanolja has expanded its global network to more than 1.3 million partners in 200 countries.

In 2022, Yanolja spent about 300 billion won to take over Interpark Inc., one of Korea’s first-generation e-commerce platforms, and Triple, a hyper-personalized platform for tour services and content, which was placed under Interpark.

Later, it sold off Interpark’s shopping and book businesses and changed the travel platform’s name to Interpark Triple.

The new travel platform has steadily expanded its presence in the country’s outbound travel market with cheap flight ticket deals and group tour services.

According to the International Air Transport Association (IATA) data, Interpark Triple rose to the top in terms of flight ticket sales among Korean travel apps in 2023.

Thanks to the strong performance of the new businesses, Yanolja is expected to speed up its listing in the US Nasdaq market.

It has been seeking to go public since 2020 when it picked its IPO managers. It initially planned an IPO in Korea but later decided to list in the US Nasdaq market.

It had attempted to go public in 2023 at the earliest.

Vision Fund, led by billionaire SoftBank founder Masayoshi Son, invested $1.7 billion in Yanolja to own a 24.9% stake in 2021. The Korean unicorn was valued at 8 trillion won at that time.

Yanolja spent much of the funds on M&As to diversify its businesses to go global.

Write to Sun A Lee at suna@hankyung.com

Sookyung Seo edited this article.

-

Travel & LeisureYanolja looks to triple foreign visitors to Korea with K-culture tours

Travel & LeisureYanolja looks to triple foreign visitors to Korea with K-culture toursJun 20, 2023 (Gmt+09:00)

3 Min read -

Travel & LeisureYanolja acquires Israeli tourism tech company Go Global Travel

Travel & LeisureYanolja acquires Israeli tourism tech company Go Global TravelMay 15, 2023 (Gmt+09:00)

1 Min read -

E-commerceYanolja likely to buy $250 mn stake in Interpark spin-off

E-commerceYanolja likely to buy $250 mn stake in Interpark spin-offOct 14, 2021 (Gmt+09:00)

1 Min read -

Pre-IPOsMasayoshi Son's top pick Yanolja eyes 2023 Nasdaq listing

Pre-IPOsMasayoshi Son's top pick Yanolja eyes 2023 Nasdaq listingJul 15, 2021 (Gmt+09:00)

4 Min read -

Enterprise valueTravel platform Yanolja’s enterprise value seen at $11 bn if listed on Nasdaq

Enterprise valueTravel platform Yanolja’s enterprise value seen at $11 bn if listed on NasdaqMar 02, 2021 (Gmt+09:00)

3 Min read -

-

-