E-commerce

Qoo10’s Korean units delay seller payments amid expansions

Qoo10 is suspected of having used money from TMON, WeMakePrice to acquire US e-commerce platform Wish -- sources

By Jul 24, 2024 (Gmt+09:00)

5

Min read

Most Read

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

NCSOFT invests in US game startup emptyvessel

Southeast Asia-based e-commerce platform Qoo10 Pte.’s units in South Korea delayed seller payments as industry sources said the online shopping giant likely faced financial troubles following aggressive global expansion through acquisitions such as the takeover of US e-tailer Wish.

Some South Korean banks suspended loans to Qoo10’s units – TMON Inc. and WeMakePrice – for payments to their sellers as some of them have been unable to withdraw their earnings as scheduled from local online shopping platforms, industry sources in Seoul said on Wednesday.

TMON notified sellers earlier this week that it is inevitable to postpone payouts, adding the company will do its utmost to make payments as soon as possible, according to the sources. Last week, WeMakeprice said payments to some 500 sellers were delayed.

“Some sellers cut or suspended sales, while customers reduced purchases, affecting transactions on TMON,” said a company official, indicating the temporary slide in deals deteriorated financial conditions for seller payments.

The total transaction value of TMON and WeMakePrice was estimated to top 1 trillion won ($722.2 million) last month.

OVERLY AGGRESSIVE

Qoo10 has reportedly postponed seller payments in Southeast Asia for about one year, according to industry sources in Seoul.

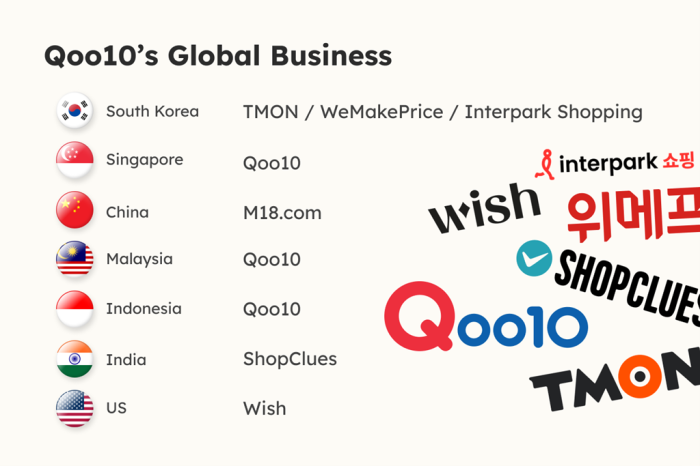

The delays came as Qoo10 aggressively expanded its global business through takeovers.

The Singapore-headquartered company acquired US online shopping platform Wish, which has businesses in some 200 countries, for $173 million from Nasdaq-listed Context Logic Inc. in February to make forays into North America and Europe.

The buyer was suspected of having used money from TMON and WeMakePrice to fund the deal, industry sources in Seoul said.

Qoo100 founded by a South Korean e-commerce pioneer Ku Young Bae in 2010 started its global expansions from Southeast Asian countries including Indonesia and Malaysia. It made inroads into other countries such as India through acquisitions. It bought ShopClues, an online marketplace in the world’s most populous country, in 2019.

Qoo10 has been actively acquiring South Korean platforms since 2022 after an agreement to ban Ku’s reentry into the country’s e-commerce business for 10 years expired. He gave this consent when he sold Gmarket Inc., a South Korean online shopping platform, to eBay Inc. in 2009.

Qoo100 purchased TMON in September 2022 from KKR & Co. and Anchor Equity Partners while taking over Interpark Commerce Corp. in March 2023 and WeMakePrice in the following month. The Singapore company acquired South Korean department store chain AK Plaza’s online shopping affiliate AK Mall for 510 million won in May this year.

FOR NASDAQ LISTING OF QXPRESS

To take over TMON and WeMakePrice, Qoo10 signed stock swap deals, in which the buyer got stakes in the South Korean shopping platforms while paying sellers with news shares issued by its logistics unit Qxpress Pte.

Qoo10 had planned to improve Qxpress’ profitability with transactions of affiliates across Asia for the logistics unit’s Nasdaq listing.

Such aggressive expansions have yet to work out. WeMakePrice’s operating loss nearly doubled to 102.5 billion won last year as sales fell 28% to 138.5 billion won. Interpark Commerce also logged a loss of 15.7 billion won.

The capital of both TMON and WeMakePrice has remained impaired by mounting losses. TMON had current liabilities of 719.3 billion won as of 2022 while its current assets totaled only 130.9 billion won, for example.

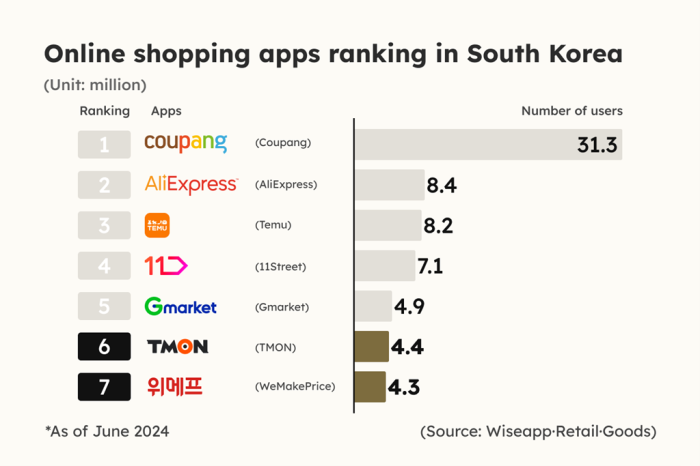

The two platforms have combined 8.7 million monthly active users (MAU) in South Korea, exceeding those of AliExpress, an e-commerce arm of China’s Alibaba Group, with MAU of 8.4 million, according to data from app analytics firm Wiseapp·Retail·Goods.

Transaction values on TMON and WeMakePrice were estimated to have totaled 1.1 trillion won last month, which could be frozen for about 45 days, a usual period needed for e-commerce platforms to make seller payments in South Korea, industry sources said.

DETERIORATION

The delays in seller payments drove not only vendors on TMON and WeMakePrice but also customers out of TMON and WeMakePrice, deteriorating the e-commerce platforms further, industry sources said.

Travel agencies such as the country’s largest Hanatour Service Inc. and Modetour Network Inc. suspended sales on TMON and WeMakePrice platforms on concerns over payment delays, while retailers including department stores followed suit.

Customers, who reserved airplane tickets, hotels or package tours through TMON and WeMakePrice, were asked to cancel them on the platforms and make payments again to those travel agencies, industry sources said.

Some food and electronics makers were poised to cancel sales events on the online marketplaces.

“We plan to cancel all product orders at once as it became difficult to keep selling products on TMON,” an official at one of the companies.

To alleviate sellers’ concerns, WeMakePrice pledged to offer deferred interest of 10% per annum to sellers damaged by delayed payments.

TMON and WeMakePrice unveiled a plan to introduce a new seller payment system next month, in which the platforms deposit money for the payouts to sellers at third-party financial firms.

NO LOANS FOR SELLER PAYMENTS

South Korea’s largest lender KB Kookmin Bank and its smaller rival Standard Chartered Bank Korea Ltd. suspended loans for seller payments to TMON and WeMakePrice.

Local banks have been offering such loans, which allow vendors on e-commerce platforms to collect the proceedings of product sales first from the lenders. Online shopping platforms give the banks the seller payments later to repay the debts.

Customers are currently unable to use credit cards for purchases on TMON and WeMakePrice.

Their seller payment delays raised concerns over the gift certificates available on the platforms.

Google and major South Korean payment service providers such as Naver Pay suspended the use of online gift vouchers sold on TMON and WeMakePrice.

South Korea’s financial authorities are monitoring the platforms’ issues with the Financial Supervisory Service checking their liquidity conditions and unpaid seller payments.

Write to Jae-Kwang Ahn, Sun A Lee and Hyun-jin Ra at ahnjk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

E-commerceQoo10 buys Korean department store AK’s e-commerce unit

E-commerceQoo10 buys Korean department store AK’s e-commerce unitMar 27, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsQoo10 buys US e-commerce platform Wish for $173 mn

Mergers & AcquisitionsQoo10 buys US e-commerce platform Wish for $173 mnFeb 13, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsQoo10 to buy another Korean rival for unit’s Nasdaq listing

Mergers & AcquisitionsQoo10 to buy another Korean rival for unit’s Nasdaq listingMar 14, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKKR, Anchor Equity tipped to exit from TMON in 7 yrs

Mergers & AcquisitionsKKR, Anchor Equity tipped to exit from TMON in 7 yrsAug 26, 2022 (Gmt+09:00)

3 Min read -

E-commerceKorea's first-generation platforms collapse, ringing in new e-commerce era

E-commerceKorea's first-generation platforms collapse, ringing in new e-commerce eraOct 05, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN