SK Group, led by SK Hynix, to invest $77 billion in AI, chips

The initiative is a ‘new SK declaration’ to transform itself into an AI-focused conglomerate, officials say

By Jul 01, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

Samsung steps up AR race with advanced microdisplay for smart glasses

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

SK Group, South Korea’s second-largest conglomerate after Samsung, is investing 106.4 trillion won ($77 billion) in artificial intelligence and semiconductors through 2028.

The planned investment will be led by SK Hynix Inc., its flagship unit and the world’s second-largest memory chipmaker, SK Telecom Co. and SK Broadband Co., the group said after a two-day strategy meeting of affiliate chief executives late last week.

Over the next five years, SK Hynix will spend 103 trillion won, of which 82 trillion won, or 80%, is earmarked for AI chips, including high-bandwidth memory (HBM), and other AI-related businesses.

SK Telecom, the country’s top mobile carrier, and affiliate SK Broadband, an internet service provider, will invest 3.4 trillion won in data centers and hardware projects.

The conglomerate said it would secure funds through corporate restructuring, including asset sales, integrating overlapping businesses and removing inefficient business practices.

The group plans to raise 80 trillion won through such efforts by key affiliates. The fund-raising plan includes securing some 30 trillion won in free cash flow within the next three years.

‘NEW SK DECLARATION’

“The outcome of the strategy meeting is tantamount to a new SK declaration to transform SK into an AI conglomerate. We’ll now focus on our main businesses that make money rather than investing in future businesses such as hydrogen and biotech. We’re going back to basics,” said an executive after the meeting of the SK Supex Council, the group’s top decision-making body.

SK Group Chairman Chey Tae-won, who’s currently on a business trip to the US, attended the meeting online.

“We must strengthen our AI value chain leadership from AI services to AI chips. In the US, everyone is talking about nothing but AI. The wind of change is strong,” he said.

Chey Chang-won, head of the SK Supex Council, said: “Pursuing new growth drivers is important. What’s more important is to do what we’re best at now.”

He said SK Group, led by SK Hynix, envisions a comprehensive AI conglomerate that would offer AI services similar to OpenAI's and sell hardware such as Nvidia Corp.'s AI chips.

SK HYNIX BETS ON HBM CHIP

Although SK Hynix ranks second in the memory sphere, it is the top player in the HBM segment, which has become an essential part of the AI boom because it provides much faster processing speed than traditional memory chips.

The company is the dominant supplier of HBM chips to Nvidia, the world’s top AI chip designer.

SK Hynix is building a 20 trillion won HBM packaging line, dubbed the M15 line, in Korea – a plant originally established for NAND chips.

The company is slated to spend 40 trillion won on building a new memory chip complex in the Yongin Semiconductor Cluster.

In the US, it is building a $3.9 billion advanced chip packaging plant and research center for AI products in Indiana.

SK officials said the planned $77 billion investment will largely come from SK Hynix.

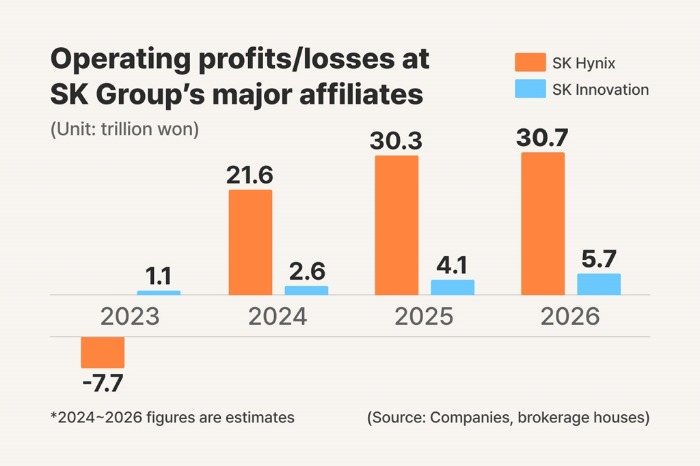

The chipmaker is widely expected to post 21.6 trillion won in operating profit this year and a combined profit of 82 trillion won over the next three years.

ASSET SALES

Recently, SK Group has been seeking asset sales and mergers among its affiliates as part of corporate restructuring to streamline its sprawling affiliates and raise funds for new businesses.

SK Innovation Co., which owns the country's largest oil refiner SK Energy Co. and battery maker SK On Co., is pursuing a merger with profitable gas affiliate SK E&S Co. to help prop up loss-making SK On.

SK Ecoplant Co., the construction engineering and waste management unit, is seeking to absorb SK Materials Co., the profit-making industrial gas business unit within SK Inc., an investment and holding company of the group.

SK Networks Co. has agreed to sell its car leasing unit SK Rent-a-Car Co. to Affinity Equity Partners for 820 billion won.

SK Inc. is negotiating to sell a major asset of its contract drug-making unit SK Pharmteco Co. in the US to Novo Nordisk A/S, a Danish multinational pharmaceutical company.

SK Inc. is also in talks to sell its 9% stake in Vietnam's Masan Group back to the retail-to-telecoms conglomerate.

SK IE Technology Co. (SKIET), an EV battery materials maker, is also up for sale, sources said.

Write to Woo-Sub Kim and Hyung-Kyu Kim at duter@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSouth Korea sets sights on fostering EDA tech to win HBM chip war

Korean chipmakersSouth Korea sets sights on fostering EDA tech to win HBM chip warJun 28, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsSK Bioscience to buy German vaccine maker IDT Biologika for $244 mn

Mergers & AcquisitionsSK Bioscience to buy German vaccine maker IDT Biologika for $244 mnJun 27, 2024 (Gmt+09:00)

4 Min read -

Korean startupsSK Innovation-backed Marine Innovation looks to enter US green market

Korean startupsSK Innovation-backed Marine Innovation looks to enter US green marketJun 25, 2024 (Gmt+09:00)

1 Min read -

Corporate restructuringSK Inc. in talks to sell Pharmteco’s US CDMO plant to Novo Nordisk

Corporate restructuringSK Inc. in talks to sell Pharmteco’s US CDMO plant to Novo NordiskJun 25, 2024 (Gmt+09:00)

2 Min read -

Corporate restructuringSK Ecoplant seeks to absorb SK Materials' industrial gas units

Corporate restructuringSK Ecoplant seeks to absorb SK Materials' industrial gas unitsJun 24, 2024 (Gmt+09:00)

4 Min read -

Corporate restructuringSK puts shares in Goldman-backed Korea Superfreeze on market

Corporate restructuringSK puts shares in Goldman-backed Korea Superfreeze on marketJun 24, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsSK Innovation looks to merge with SK E&S for organic growth

Mergers & AcquisitionsSK Innovation looks to merge with SK E&S for organic growthJun 20, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025May 30, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEO

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEOMay 02, 2024 (Gmt+09:00)

5 Min read -

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacy

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacyApr 19, 2024 (Gmt+09:00)

4 Min read