Samsung’s biotech duo on a roll with $1.1 bn CMO order

In 2024, Samsung Biologics' revenue is projected to surpass the 4-trillion-won mark

By Jul 03, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Samsung steps up AR race with advanced microdisplay for smart glasses

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

Samsung Group is on track to rise to the top of biosimilar companies in the world and become South Korea’s largest drug maker for contract manufacturing since its foray into the biotechnology market in 2011.

Samsung Biologics Co., a contract manufacturing organization (CMO), said on Tuesday it has bagged its largest-ever order worth $1.06 billion, under which it will deliver a drug product to a US pharmaceutical company by the end of 2030.

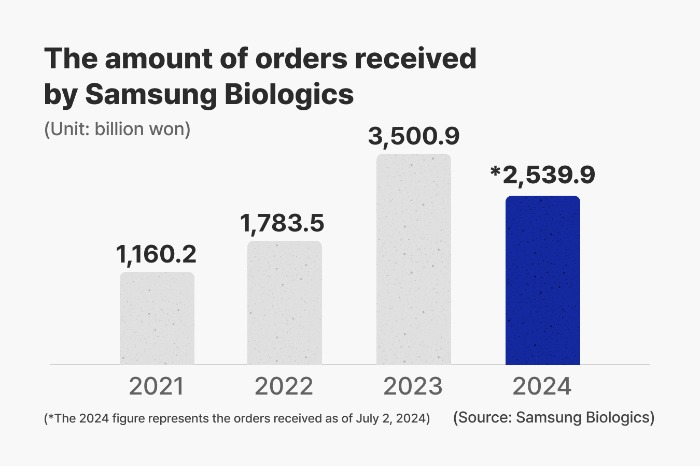

The deal represents 42% of the orders it received in the entire year of 2023. It did not disclose the name of the product or the US company, citing their confidentiality agreement.

Samsung Securities senior analyst Seo Keunhee assumes the product for the CMO order would be a blockbuster drug, given the size of the deal. She said the drug could be an Alzheimer’s treatment, a cancer immunotherapy drug, or an antibody-drug-conjugate.

The same day, Samsung Bioepis Co. said that Pyzchiva, its biosimilar to Johnson & Johnson’s autoimmune disease treatment Stelara, has won US Food and Drug Administration (FDA) approval, becoming its seventh biosimilar to get the nod from the FDA.

Pyzchiva will be commercialized by Sandoz, a Switzerland-based biosimilar manufacturing arm of Novartis AG, in the US.

SAMSUNG BIOLOGICS

With the latest CMO deal, Samsung Biologics has secured a total of 2.5 trillion won ($1.8 billion) worth of orders so far this year, bringing its cumulative orders received to $12.5 billion since its inception in 2011.

This year, its revenue is projected to surpass the 4-trillion-won ($2.9 billion) mark for the first time as a South Korean biosimilar maker.

Its sales growth is credited to its overwhelming production capacity, alongside manufacturing speed and quality. When its fifth plant is fully operational next year, its capacity will reach 784,000 liters a year.

Of the seven orders received this year, six were follow-up orders to increase the production volume of existing contracts.

Samsung counts 16 of the top 20 global pharmaceutical companies in terms of market capitalization as its customers.

SAMSUNG BIOEPIS

Pyzchiva has been approved for the treatment of plaque psoriasis, psoriatic arthritis, Crohn's disease and ulcerative colitis. Sales of its original drug Stelara have reached around 14 trillion won annually.

As of June 2024, Samsung Bioepis has seven biosimilars approved in the US, the largest number of FDA-approved biosimilars for a company in the world. It has now matched that of Amgen Inc., a US biopharmaceutical company.

Pfizer Inc. and Sandoz have five and four biosimilars approved by the FDA, respectively.

Samsung also has four generic drugs commercially available. Additionally, it is expected to win FDA approval for its first hematology biosimilar to Soliris, Alexion Pharmaceuticals’s blockbuster disease, this month.

If the biosimilar, dubbed Epysqli, gets the greenlight from the US drug authorities as a rare blood disorder treatment, Samsung will leap to the top of biosimilar makers in the world with the largest number of FDA approvals.

Alexion Pharmaceuticals is a unit of the US-based AstraZeneca.

Write to Dae-Kyu Ahn at powerzanic@hankyung.com

Yeonhee Kim edited this article

-

Bio & PharmaSamsung Biologics eyes windfall gain amid US-China row

Bio & PharmaSamsung Biologics eyes windfall gain amid US-China rowJun 07, 2024 (Gmt+09:00)

3 Min read -

Bio & PharmaSamsung Bioepis leads in Soliris biosimilar market in Europe

Bio & PharmaSamsung Bioepis leads in Soliris biosimilar market in EuropeMay 27, 2024 (Gmt+09:00)

3 Min read -

Bio & PharmaSamsung Bioepis gets OK to sell Stelara biosimilar in Europe

Bio & PharmaSamsung Bioepis gets OK to sell Stelara biosimilar in EuropeApr 23, 2024 (Gmt+09:00)

1 Min read -

Bio & PharmaSamsung Biologics signs ADC CDO deal with LegoChem Bio

Bio & PharmaSamsung Biologics signs ADC CDO deal with LegoChem BioFeb 07, 2024 (Gmt+09:00)

3 Min read -

Bio & PharmaSamsung Biologics reaches record-breaking annual orders

Bio & PharmaSamsung Biologics reaches record-breaking annual ordersNov 28, 2023 (Gmt+09:00)

1 Min read -

-

Bio & PharmaSamsung Bioepis gets FDA OK for its interchangeable biosimilar

Bio & PharmaSamsung Bioepis gets FDA OK for its interchangeable biosimilarOct 25, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaSamsung Biologics wins $242 mn order from Bristol Myers Squibb

Bio & PharmaSamsung Biologics wins $242 mn order from Bristol Myers SquibbSep 18, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaSamsung Bioepis seeks to buy Biogen biosimilar unit

Bio & PharmaSamsung Bioepis seeks to buy Biogen biosimilar unitAug 02, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaNovartis $391 mn deal powers Samsung Biologics backlogs to record high

Bio & PharmaNovartis $391 mn deal powers Samsung Biologics backlogs to record highJul 10, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaSamsung Biologics to invest $1.5 bn for 5th CDMO factory

Bio & PharmaSamsung Biologics to invest $1.5 bn for 5th CDMO factoryMar 16, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaSamsung Biologics wins $897 mn in two deals with Pfizer

Bio & PharmaSamsung Biologics wins $897 mn in two deals with PfizerJul 04, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaSamsung Bioepis to enhance biosimilar presence with Epysqli

Bio & PharmaSamsung Bioepis to enhance biosimilar presence with EpysqliJun 12, 2023 (Gmt+09:00)

3 Min read -

Bio & PharmaSamsung Biologics, Pfizer sign $411.3 mn agreement for long-term CDMO

Bio & PharmaSamsung Biologics, Pfizer sign $411.3 mn agreement for long-term CDMOJun 08, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaSamsung Biologics to double production by 2032; eyes ADCs, M&As

Bio & PharmaSamsung Biologics to double production by 2032; eyes ADCs, M&AsJun 07, 2023 (Gmt+09:00)

4 Min read -

Bio & PharmaSamsung Biologics bags $183 million CMO order from Pfizer

Bio & PharmaSamsung Biologics bags $183 million CMO order from PfizerMar 02, 2023 (Gmt+09:00)

2 Min read -

EarningsSamsung Biologics’ profit near doubles on strong orders

EarningsSamsung Biologics’ profit near doubles on strong ordersJan 29, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaKorea's Samsung Biologics signs $296 mn CMO deal with GSK

Bio & PharmaKorea's Samsung Biologics signs $296 mn CMO deal with GSKOct 21, 2022 (Gmt+09:00)

1 Min read -

Bio & PharmaSamsung Biologics opens the world's largest CDMO factory

Bio & PharmaSamsung Biologics opens the world's largest CDMO factoryOct 11, 2022 (Gmt+09:00)

1 Min read -

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plans

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plansFeb 24, 2022 (Gmt+09:00)

3 Min read -

PharmaceuticalsSamsung Bioepis posts $1.26 billion in global biosimilar sales

PharmaceuticalsSamsung Bioepis posts $1.26 billion in global biosimilar salesFeb 18, 2022 (Gmt+09:00)

2 Min read -

BiosimilarsSamsung Bioepis gets FDA approval for Lucentis biosimilar Byooviz

BiosimilarsSamsung Bioepis gets FDA approval for Lucentis biosimilar ByoovizSep 23, 2021 (Gmt+09:00)

3 Min read