Cosmax mulls building cosmetics factory in Latin America

The plant would be the sixth overseas manufacturing facility for South Korea's No. 1 cosmetics ODM

By Jul 04, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

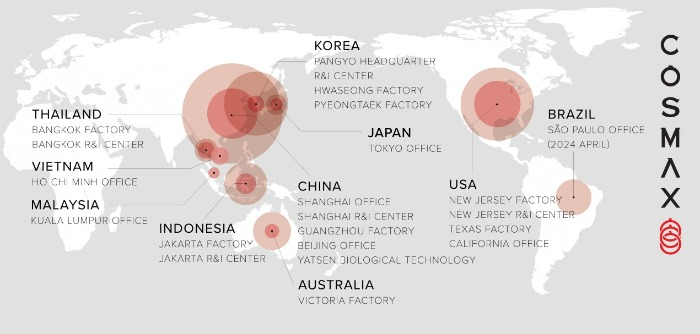

Cosmax Inc., South Korea's biggest cosmetics original development and design manufacturer (ODM), is considering building a new offshore plant in Latin America to meet burgeoning demand for its beauty products from around the world amid the ongoing Hallyu, or Korean Wave.

“We are reviewing a plan to build a new factory in either Mexico or Brazil to cement our position in Latin America and diversify our global supply chain,” Choi Kyoung, vice chairman of Cosmax, said on Thursday.

If the new facility is built, it would be the Korean cosmetics ODM giant’s sixth overseas manufacturing facility after plants in China, Indonesia, the US, Thailand and Japan.

It is currently building a plant in Ibaraki, Japan to be completed by the second half of next year.

Cosmax has turned aggressive in ramping up output to deal with a surge in ODM orders thanks to the so-called K-Beauty sensation across the world.

The company, which supplies its beauty products to 2,685 companies from around the world, expects to win about 520 new clients this year.

It develops and manufactures cosmetics for not only small Korean beauty companies but also global giants such as L'Oréal Group.

It has already launched a task force to speed up its forays into the Middle East, India, Africa and Latin America.

TRENDSETTER IN THE BEAUTY WORLD

Cosmax ranks first among the world’s top three cosmetics ODMs, followed by Intercos Group in Italy and its crosstown rival Kolmar Korea Co.

Cosmax and Kolmar produce about 2.9 billion and 1.6 billion items per year, respectively, from their manufacturing facilities at home and abroad.

They are behind the recent ascent of Korean beauty products in the global market.

The K-Beauty boom, which was originally started by Korea’s household names like Amorepacific Corp., is now driven by small Korean cosmetics companies such as Skin 1004 and Beauty of Joseon.

According to Korea’s Ministry of SMEs and Startups, cosmetics exports by SMEs accounted for 67.4% of the country’s total cosmetics outbound shipments.

They don’t have own manufacturing facilities or research and development capability but when their product and marketing ideas meet with Korea’s top two ODMs, Cosmax and Kolmar, they can debut their real beauty products in the market that sell well.

TRAILBLAZER

Armed with world’s leading development and manufacturing capabilities, Cosmax and Kolmar have each invested 57% of their total revenue into R&D every year over the past few decades.

Cosmax boasts 1,300 staff working at its R&D centers at home and abroad.

As more consumers care about cosmetics’ ingredients and reviews, beauty products manufactured by Korean ODMs are considered relatively high quality compared to products from fragmented cosmetics markets, thus they rank higher in sales, said George Rivera, the chief executive officer of Kolmar USA.

Cosmax and Kolmar are also adept at quickly reflecting changes in beauty trends in products.

This is why Amazon.com has recently asked Kolmar Korea to co-host the Amazon K-Beauty Conference in Korea.

Thanks to the growing demand for their products, Kolmar Korea also expects to see a 48.8% jump in new customers this year from last year’s 170.

It has also been also actively seeking to expand its presence in overseas markets such as the US and the Middle East. It aims to complete its second US plant in Pennsylvania early next year.

According to estimates by securities firms, Cosmax and Kolmar Korea are projected to see 70.6% and 43.8% on-year gains in operating profit this year to 197.4 billion won ($143 million) and 195.7 billion won, respectively.

Cosmax sales are also expected to hit its record high of 2.20 trillion won this year while Kolmar Korea would reap its highest-ever 2.45 trillion won.

Write to Hun-Hyoung Ha and Hyung-Joo Oh at hhh@hankyung.com

Sookyung Seo edited this article.

-

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reach

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reachJun 26, 2024 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands grow

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands growJan 18, 2024 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsKorea's Cosmax strengthens business in Middle East, Africa

Beauty & CosmeticsKorea's Cosmax strengthens business in Middle East, AfricaJan 11, 2024 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsCosmax targets Thailand with K-beauty cosmetic formulations

Beauty & CosmeticsCosmax targets Thailand with K-beauty cosmetic formulationsNov 27, 2023 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsCosmax opens Asia's largest cosmetics plant in China

Beauty & CosmeticsCosmax opens Asia's largest cosmetics plant in ChinaAug 14, 2023 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsCosmax to make inroads into Japanese market in earnest

Beauty & CosmeticsCosmax to make inroads into Japanese market in earnestJan 19, 2023 (Gmt+09:00)

1 Min read