Hyundai Steel set to supply iron powder to Korean LFP cathode makers

L&F and EcoPro BM plan to mass-produce LFP battery materials starting around the end of next year

By Sep 20, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Samsung steps up AR race with advanced microdisplay for smart glasses

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

Hyundai Steel Co., a unit of South Korean automotive group Hyundai Motor Co., is set to enter the battery materials business by supplying iron powder, a key battery raw material, to lithium ion phosphate (LFP) battery cathode makers as early as next year.

In partnership with battery materials makers L&F Co., EcoPro BM Co. and LG Chem Ltd., Hyundai Steel is test-producing iron powder for use in cathodes, a key component of lithium-ion cells, people familiar with the matter said on Friday.

Hyundai has received positive feedback from its battery materials partners, raising the chances of commercial production, sources said.

While Hyundai Steel has already been producing iron powder, its use has been limited, primarily as a material for certain car engine parts — a relatively small market.

Sources said the company aims to become part of Korea’s battery materials supply chain.

Hyundai is capable of supplying some 50,000 to 60,000 tons of iron powder annually, enough for 1 million electric vehicles, they said.

SHIFT GEARS TO LFP BATTERIES

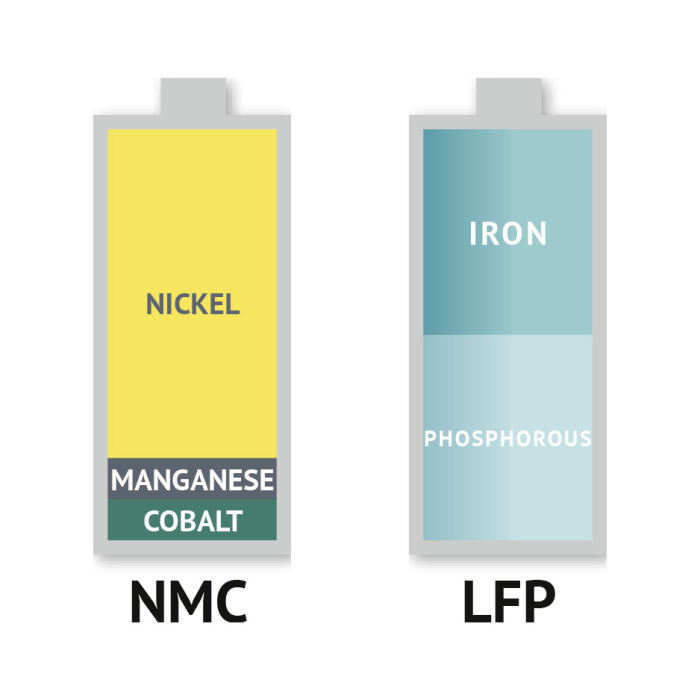

Korea’s three major battery makers — LG Energy Solution Ltd., SK On Co. and Samsung SDI Co. — have mostly produced nickel-cobalt-manganese (NCM) cells.

But they are now shifting gears to produce low-end LFP cells on growing demand for the rival LFP type that is especially popular among entry-level EVs made by Tesla Inc. and other major EV makers.

The Korean trio are expected to produce LFP batteries in large quantities starting in 2026.

Most LFP batteries are made by Chinese companies such as Contemporary Amperex Technology Co. Ltd. (CATL), the world’s top battery maker, and BYD Co.

LFP cells are lower in energy density but cheaper to make compared with other types such as NCM batteries, making them more suitable for low-end EV models. LFP batteries are also more stable, making them less susceptible to fire.

CATHODES FOR LFP BATTERIES

Domestic battery materials makers are gearing up for LFP cathodes.

Companies such as L&F and EcoPro BM are slated to begin mass production of LFP cathodes toward the end of 2025.

They will each initially produce 45,000 tons a year of LFP cathodes.

LG Energy’s parent company LG Chem plans to start mass production of LFP cathodes as early as 2027, according to industry officials.

LG Energy, the world’s second-largest battery maker, said in July it clinched a multi-billion-dollar deal to supply LFP batteries for low-end electric vehicles to Renault Group’s EV unit Ampere.

Under the five-year contract, LG will provide LFP batteries to Ampere from late 2025 through 2030, with a total capacity of some 39 GWh, enough to power 590,000 EVs.

While Korean battery materials makers will receive iron powder from domestic suppliers, they are expected to continue to import two other LFP cathode materials — lithium and phosphate — from Chinese companies, industry officials said.

Hyundai Steel’s advance into the battery raw materials arena comes as the domestic steel industry is reeling from a supply glut, triggered by Chinese steelmakers’ aggressive steel exports.

Hyundai Steel’s operating profit this year is estimated by market analysts at 450.3 billion won ($338 million), sharply down from a high of 2.45 trillion won in 2021.

Write to Sang-Hoon Sung at uphoon@hankyung.com

In-Soo Nam edited this article.

-

BatteriesLG Energy signs multi-billion-dollar LFP battery deal with Renault

BatteriesLG Energy signs multi-billion-dollar LFP battery deal with RenaultJul 02, 2024 (Gmt+09:00)

3 Min read -

BatteriesSodium-ion batteries emerge as alternative to lithium, LFP batteries

BatteriesSodium-ion batteries emerge as alternative to lithium, LFP batteriesNov 27, 2023 (Gmt+09:00)

3 Min read -

SteelSouth Korean steelmakers run plants only at night as demand plummets

SteelSouth Korean steelmakers run plants only at night as demand plummetsJun 05, 2024 (Gmt+09:00)

3 Min read -

BatteriesLG’s $5.5 billion LFP, ESS battery plants in Arizona to kick off in 2026

BatteriesLG’s $5.5 billion LFP, ESS battery plants in Arizona to kick off in 2026Apr 04, 2024 (Gmt+09:00)

3 Min read -

BatteriesLG Energy expedites LFP battery supply chain expansion

BatteriesLG Energy expedites LFP battery supply chain expansionFeb 22, 2024 (Gmt+09:00)

2 Min read -

-

BatteriesKorean firms confident they can outpace China in LFP battery race

BatteriesKorean firms confident they can outpace China in LFP battery raceSep 11, 2023 (Gmt+09:00)

5 Min read -

BatteriesKorean firms fret over growing adoption of Chinese LFP batteries

BatteriesKorean firms fret over growing adoption of Chinese LFP batteriesAug 28, 2023 (Gmt+09:00)

4 Min read