Banking & Finance

Samsung flexes financial muscle as insurance, card units top rankings

Group’s flagship financial arms posted 1.67 trillion won in combined Q1 net profit, closing in on KB’s 1.70 trillion won lead

By 4 HOURS AGO

2

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Mubadala, Goldman Sachs to invest $700 mn in Kakao Mobility

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Seoul-backed K-beauty brands set to make global mark

Samsung Group’s financial affiliates are closing in on KB Financial Group for the top spot in South Korea’s financial services sector, underscoring Samsung’s disciplined management amid an economic slowdown.

According to company filings, Samsung Life Insurance Co., Samsung Fire & Marine Insurance Co. and Samsung Card Co. all secured the top position in their respective sectors in terms of net profit during the first quarter.

The three affiliates’ strong performance comes as the domestic financial sector faces mounting headwinds from tepid consumer sentiment and stagnant market conditions.

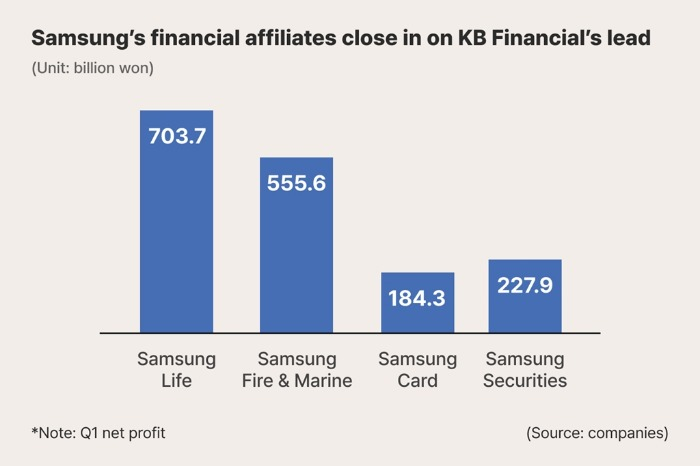

Samsung Life, the flagship of the group’s financial arm, posted 703.7 billion won ($506 million) in net profit in the first three months of this year on a standalone basis, up 8% from a year earlier, despite a deterioration in the broader life insurance industry.

SAMSUNG LIFE’S DOMINANCE

With the results, Samsung Life ranked top not just in the life insurance sector but also in the overall insurance business, including the non-life segment.

Two closest rivals Kyobo Life Insurance Co. and Hanwha Life Insurance Co. posted 315.3 billion won and 122 billion won in net profit, respectively.

Samsung Fire & Marine saw its net profit fall 18.8% on-year to 555.6 billion won, reflecting industry-wide challenges, including higher claims and investment losses.

Nevertheless, the company maintained its leadership in the non-life segment, as peers such as DB Insurance Co. and Hyundai Marine & Fire Insurance Co. saw steeper declines in profitability.

Samsung Card posted a 3.9% on-year increase in net profit to 184.3 billion won, extending its lead in the card business for a second consecutive year.

Samsung Securities Co., meanwhile, saw net profit slide 3.4% to 227.9 billion won, ranking third after Korea Investment & Securities Co. and Mirae Asset Securities Co.

NON-BANKING UNITS DRIVE PROFITABILITY

In aggregate, the four financial units under Samsung reported a combined net profit of 1.67 trillion won on a non-consolidated basis, trailing KB Financial’s 1.70 trillion won.

Notably, Samsung’s tally excludes earnings from subsidiaries, which, if consolidated, would put its financial units ahead of KB.

Analysts said the fierce competition between the two financial conglomerates – Samsung and KB – reflects the shifting dynamics in Korea’s financial services sector, where non-bank units are increasingly driving profitability amid margin pressures in traditional lending businesses.

“The first-quarter results once again highlight Samsung’s strength in operational management and risk controls, particularly in insurance and card businesses where disciplined underwriting and cost efficiency remain key differentiators,” said a Seoul-based analyst at a domestic brokerage.

Write to Hyung-gyo Seo at seogyo@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Corporate restructuringSamsung Life, Samsung Fire sell $193 mn in Samsung Electronics shares

Corporate restructuringSamsung Life, Samsung Fire sell $193 mn in Samsung Electronics sharesFeb 12, 2025 (Gmt+09:00)

2 Min read -

Corporate restructuringSamsung Life mulls putting Samsung Fire under its wing as subsidiary

Corporate restructuringSamsung Life mulls putting Samsung Fire under its wing as subsidiaryFeb 04, 2025 (Gmt+09:00)

3 Min read -

Banking & FinanceSamsung seeks to launch new super mobile banking app with a local bank

Banking & FinanceSamsung seeks to launch new super mobile banking app with a local bankMar 25, 2024 (Gmt+09:00)

3 Min read -

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake sale

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake saleSep 02, 2020 (Gmt+09:00)

5 Min read

Comment 0

LOG IN