Asset management

South Korean brokerages woo super-rich to make them even richer

With billions of dollars flowing into brokerages, wealth managers and private bankers cater to the wealthiest investors

By Jul 02, 2024 (Gmt+09:00)

3

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

South Korea’s baby boomers, the demographic cohort born between 1955 and 1963, have largely built their wealth through hard work, savings and then stock investment.

In recent years, the younger nouveau riche, or the young rich, armed with high financial literacy, have often amassed wealth through aggressive, highly leveraged stock and cryptocurrency investments.

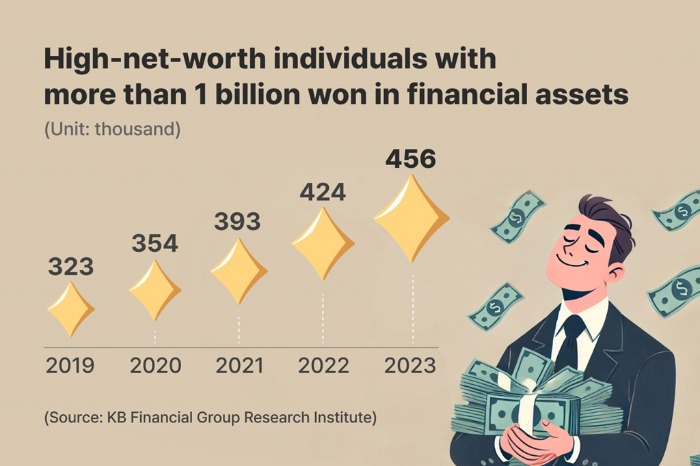

The number of high-net-worth individuals (HNWIs) in Asia’s fourth-largest economy is growing and they want to become even richer, seeking help from private bankers (PBs) and wealth managers at brokerage firms and banks.

According to a recent analysis of financial data by The Korea Economic Daily, the combined financial assets managed by 10 major domestic brokerage houses’ wealth management and retail financial divisions reached 1,060 trillion won ($763 billion) as of May, up from 1,006 trillion won at the end of 2023.

Financial data in the first five months shows some 11 trillion won in such funds have flown into securities firms every month.

Samsung Securities Co. topped the list with 14.8 trillion won coming their way in the January-May period, followed by Korea Investment & Securities Co. with 11.8 trillion won, KB Securities Co. with 8.3 trillion won, NH Investment & Securities Co. with 8.1 trillion won and Mirae Asset Securities Co. with 7.1 trillion won.

With the rise of affluent retail investors, financial institutions are wooing them with attractive financial products with higher returns and fielding able private bankers to whet their appetite for wealth management.

“Over the past five years, our retail assets have increased by 24% on average annually. With high-net-worth individuals aggressively seeking high-yield products, the wealth management business’s growth potential is huge,” said Kim Sung-hwan, chief executive of Korea Investment & Securities.

INDIVIDUAL WEALTH MANAGEMENT: GROWING SECTOR

In the past, the main source of revenue for securities companies was brokerage fees for stock trading.

Such commissions, however, have been declining amid intensified competition among securities firms and a proliferation of mobile transactions.

The number of stock investors is also falling.

Just like any other major economies, the Korean stock market had been a mine of gold even for small investors during the COVID-19 pandemic.

With limited options to spend due to curbs on travel and stay-at-home guidelines, a gush of fresh money found its way to the stock market, pushing up the Kospi index to a record level.

At the height of the pandemic, stock trading accounts in Korea ballooned to 70 million, with every single Korean owning 1.4 stock trading accounts on average.

“Now that the Korean stock market is mature, securities firms find it hard to make money through stock brokering and commissions,” said a domestic brokerage house official.

The Korean investment banking segment is also dwindling, prodding brokerage firms to turn to individual wealth management, after the sector suffered huge losses from the faltering overseas commercial property market and the domestic real estate project financing crisis, analysts said.

“It is easier for one PB (private banker) to manage a client with 100 billion won in financial assets than serving 100 clients with 1 billion won each,” said a private banker at a securities firm. “You also get higher incentives for managing high-stake transactions.”

Write to Ye-Jin Jun, Han-Shin Park and Eunhyeok Ryu at ace@hankyung.com

In-Soo Nam edited this article.

More to Read

-

MarketsKorea’s super-rich: How their wealth ballooned during the pandemic

MarketsKorea’s super-rich: How their wealth ballooned during the pandemicJun 24, 2021 (Gmt+09:00)

3 Min read -

Asset managementYoung rich Koreans set sights on M&As, commercial property deals

Asset managementYoung rich Koreans set sights on M&As, commercial property dealsMay 19, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketSuper-rich Koreans eye return to stocks despite weaker economy

Korean stock marketSuper-rich Koreans eye return to stocks despite weaker economyApr 10, 2023 (Gmt+09:00)

2 Min read -

MarketsKorea’s stock markets rise most among majors; beat S&P 500, Nasdaq gains

MarketsKorea’s stock markets rise most among majors; beat S&P 500, Nasdaq gainsDec 30, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN