UCK Partners advises Korean-style approach for buyout deals

The PE firm has bought a 72% stake in Korean companies on average, with their owner families keeping the remaining stake

By Oct 16, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

An increasing number of South Korean companies are on the radar of private equity investors as the firms undergo digital transformation and generational shifts in top management amid the descent of traditional enterprises and their weak governance, said Kim Soomin, founder and chief executive of UCK Partners, on Wednesday.

The rapid growth in homegrown private equity firms and their various strategies will leave domestic companies exposed to management buyout attempts by PE players with plenty of dry powder.

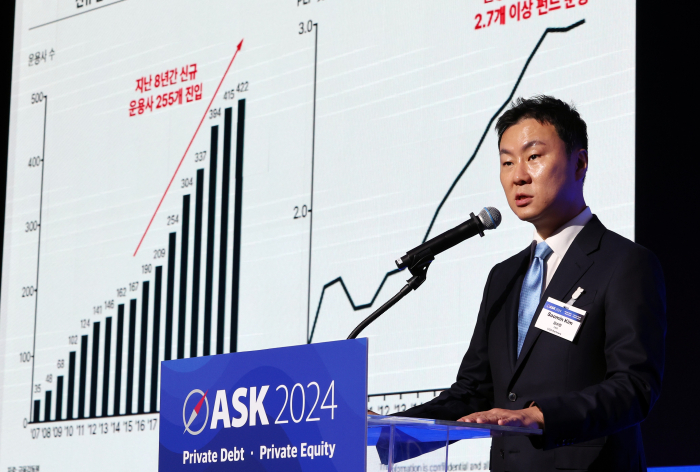

"I think it is inevitable and unavoidable for them to reach a point of connection with private equity," he said in a keynote speech for the global investment conference ASK 2024.

"The diversity of deal types are stoking vague fears over private equity, but at the same time I believe disputes [between private equity firms and companies] will lead to synergy and value creation."

In that context, private equity funds need to transform into solution providers from capital providers to the companies they invest in, with longer-term investment horizons and management expertise.

Companies are advised to embrace private equity firms as business partners, beyond their capital capabilities, to be open-minded to their business strategy suggestions, Kim noted.

"We need a different approach in South Korea from that of Western-style buyouts. I believe that the Korean-style [buyout strategy] that pursues coexistence will sustainably generate high investment returns."

The domestic private equity market has expanded by a compound annual growth rate of 19% over the past 16 years to 136 trillion won ($100 billion) in 2023 in terms of committed capital, according to the Financial Supervisory Service.

Homegrown private equity firms' dry power available for overseas deals exceeded 200 trillion won as of 2023.

A total of 225 new PE houses have entered the domestic PEF market over the past eight years, of which more than 100 players have 10 years' track record or more.

UCK Partners' cumulative investments in South Korea reached 3 trillion won. It is the most active buyout fund in the country with 19 buyout deals, Kim said.

With a focus on mid-cap buyouts, it has been chasing proprietary deals, instead of participating in bids. Its CEO said the companies it had invested in grew by an average of 3.8% in terms of earnings before interest, tax, depreciation and amortization by the time of exiting.

In 2019, UCK, formerly Unison Capital, made a lucrative exit from bubble tea chain Gong Cha Korea.

It sold the franchise operator that also controls Gong Cha’s Japanese and Taiwanese operations to US investment firm TA Associates Management LP for 350 billion won in 2019, about six times its earnings before interest, taxes, depreciation and amortization (EBITDA).

Write to Yeonhee Kim at yhkim@hankyung.com

Jennifer Nicholson-Breen edited this article.

-

Leadership & ManagementCorporate management disputes spring up in S.Korea

Leadership & ManagementCorporate management disputes spring up in S.KoreaOct 14, 2024 (Gmt+09:00)

4 Min read -

Shareholder activismFlashlight Capital offers to buy KT&G’s ginseng business for $1.4 billion

Shareholder activismFlashlight Capital offers to buy KT&G’s ginseng business for $1.4 billionOct 14, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea Zinc

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea ZincOct 14, 2024 (Gmt+09:00)

4 Min read -

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea Zinc

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea ZincSep 13, 2024 (Gmt+09:00)

4 Min read -

Private equityKorean LPs seek private equity secondaries amid liquidity crunch

Private equityKorean LPs seek private equity secondaries amid liquidity crunchFeb 01, 2024 (Gmt+09:00)

4 Min read -

Corporate governanceSK Ecoplant seeks to establish eco holding firm, sell 40% stake to PEFs

Corporate governanceSK Ecoplant seeks to establish eco holding firm, sell 40% stake to PEFsMay 30, 2023 (Gmt+09:00)

3 Min read -

Private equityMore Korean LPs look to buyouts, special situations for private equity

Private equityMore Korean LPs look to buyouts, special situations for private equityApr 24, 2023 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for sale

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for saleJul 05, 2022 (Gmt+09:00)

2 Min read -

-

Korean startupsSpecialty coffee brand Terarosa raises $60 mn from Unison Capital

Korean startupsSpecialty coffee brand Terarosa raises $60 mn from Unison CapitalNov 02, 2021 (Gmt+09:00)

1 Min read -

![[Dealmaker] Unison Capital shines in Korea’s niche sectors](/data/ked/image/2020/02/Unison-Capital.145x94.0.png) Private equity[Dealmaker] Unison Capital shines in Korea’s niche sectors

Private equity[Dealmaker] Unison Capital shines in Korea’s niche sectorsFeb 15, 2020 (Gmt+09:00)

4 Min read -

Unison Capital agrees to sell Gong Cha to US PEF for $300 mn

Unison Capital agrees to sell Gong Cha to US PEF for $300 mnAug 26, 2019 (Gmt+09:00)

1 Min read