Korean chipmakers

Samsung, SK Hynix ramp up DRAM business on rapid AI growth

Jeong-Soo Hwang, Chae-Yeon Kim and Eui-Myung Park

Sep 02, 2024 (Gmt+09:00)

Samsung Electronics Co. and SK Hynix Inc.,the world’s two largest memory chipmakers, are expanding their dynamic random access memory business as the global DRAM market is expected to surpass the foundry sector thanks to rapid growth in artificial intelligence.

Samsung, the global memory chip leader, decided to build a PH3 production line for DRAM and other components at its semiconductor manufacturing complex in Pyeongtaek, Gyeonggi Province, South Korea while suspending the construction of a foundry clean room, industry sources in Seoul on Monday.

The factory is expected to produce DRAM chips for high-bandwidth memory (HBM) chips, which will be equipped in Advanced Micro Devices Inc.’s (AMD) AI accelerators, those sources said. An HBM is made by stacking advanced DRAM chips.

“Samsung is first installing equipment for DRAM production at the P4,” one of the sources said, referring to its fourth semiconductor complex in Pyeongtaek.

MORE INVESTMENTS

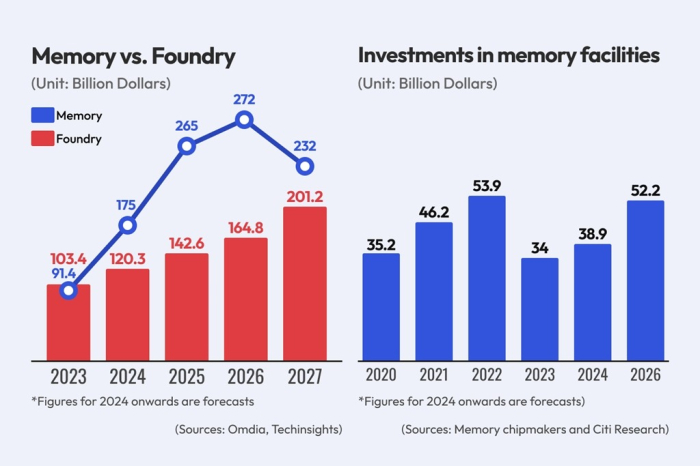

The company’s capital expenditures for DRAM, excluding spending on building construction, are expected to grow 9.2% to $9.5 billion in 2024, the largest since 2020, according to Citigroup. The capex is likely to increase further to $12 billion in 2025.

SK Hynix, which had cut output last year, was poised to more than triple spending on DRAM chips to $7.1 billion this year from $2.3 billion in 2023. The investments in the sector will rise further to $10.5 billion next year.

“About 65% of memory chip investments will be spent on DRAM,” said Peter Lee, co-head of Citi’s global tech & communications unit. “Much will be set aside for high-value-added DRAM such as HBM.”

The global memory chip market is growing. The industry, which includes DRAM and NAND flash chips, was forecast to nearly double to $175 billion this year, topping the foundry industry of $120.3 billion dominated by Taiwan Semiconductor Manufacturing Co., according to industry analysis firms Omdia and Techinsights Inc.

The memory chip market is likely to exceed the $200 billion mark for the first time in 2025, when the DRAM market is set to reach $162 billion.

Samsung and SK Hynix are set to invest billions of dollars to develop next-generation products such as processing in memory (PIM), which performs central processing unit (CPU) operation in memory, and computer express link (CXL), a unified interface that adds efficiency to accelerators, DRAM and storage devices used with CPUs and graphics processing units (GPUs) in high-performance server systems.

“Memory chips have grown faster than CPUs in the semiconductor industry history,” said Hwang Cheol-Seong, a professor at Seoul National University’s Department of Materials Science and Engineering, Hybrid Materials.

“Memory chips are expected to play various roles including computation to solve the problem of slowing performance due to the increase in data,” said Hwang, who led the Inter-University Semiconductor Research Center of the country’s top college from 2014 to 2015.

RISING CAPACITY

SK Hynix, the world’s No. 2 memory chipmaker, received a tempting offer from an AI accelerator maker earlier this year. The company asked the South Korean tech behemoth to establish a dedicated memory chip production line, saying it would make an advanced payment of more than 500 billion won.

SK Hynix turned down the offer as it is committed to supplying products worth over 1 trillion won to Nvidia Corp., the global No. 1 AI chip maker.

“That was an anecdote of the era of memory-centric computing amid the rapid growth of AI,” said an industry source in Seoul. Memory-centric computing aims to enable computation capability in and near all places where data is generated and stored.

Memory chipmakers are ramping up DRAM production volumes.

The global RAM capacity was forecast to grow to 1.8 million units a month this year and 1.9 million in 2025 from 1.5 million last year, according to industry tracker DRAMeXchange.

Such increases caused worries about oversupply, which memory chipmakers defied.

Bloomberg reported that 13 Big Tech companies in the US and China such as Google and Alibaba Group plan to invest a total of $226.2 billion in AI data centers this year, up 33.7% from 2023. Their investments are expected to grow 13.4% to $256.6 billion in 2025.

Most of the budget is likely to be spent on AI accelerators, maintaining the DRAM market boom for some time, industry sources said.

The prices of HBM, which is predicted to account for 26% of Samsung’s DRAM capacity and 28% of SK Hynix’s DRAM production as of the end of 2025, are five or six times those of double data rate 5 (DDR5) products, the latest general purpose DRAM chips. That will drive up the two South Korean chipmakers’ profitability.

Samsung and SK Hynix are both predicted to enjoy operating profit margins of more than 40% this year, industry analysts said.

Write to Jeong-Soo Hwang, Chae-Yeon Kim and Eui-Myung Park at hjs@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Memory chip demand to stay firm until H1 2025: SK Hynix CEO

Aug 07, 2024 (Gmt+09:00)

-

SK Hynix to supply 12-layer HBM3E to Nvidia in Q4; profit soars in Q2

Jul 25, 2024 (Gmt+09:00)

-

Samsung sets sights on next-generation memory CXL DRAM

Jul 18, 2024 (Gmt+09:00)

-

SK Hynix to invest $14.6 bn to build HBM plant in S.Korea

Apr 24, 2024 (Gmt+09:00)

-

Samsung holds DRAM supremacy with its market share at 7-year high

Feb 27, 2024 (Gmt+09:00)

-

SK Hynix showcases cutting-edge CXL, AiM memory at OCP Summit

Oct 20, 2023 (Gmt+09:00)

-

Samsung starts building 4th semiconductor plant in Pyeongtaek

Dec 27, 2022 (Gmt+09:00)