Leadership & Management

Hanwha’s heir apparent to unearth new drivers, tighten grip

Sang Hoon Sung and Hyeon-woo Oh

Aug 29, 2024 (Gmt+09:00)

Hanwha Group has appointed the eldest son of Chairman Kim Seung-youn to lead the investment division of the group’s eco-friendly energy unit in a mid-year management shakeup, a move seen as also helping the son tighten his grip on South Korea’s seventh-largest conglomerate.

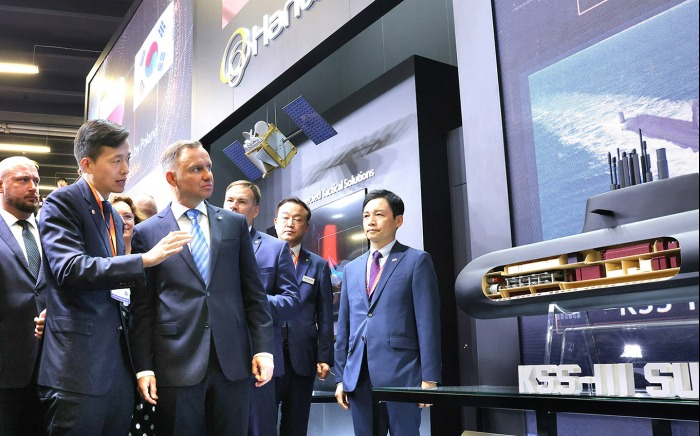

Hanwha Group said on Thursday it reshuffled leadership at seven units, including core businesses such as Hanwha Ocean, Hanwha Aerospace and Hanwha Impact Co.

The chairman's son, Kim Dong-kwan, Hanwha Group’s vice chairman, as well as the chief executive officer of Hanwha Solutions Corp., Hanwha Aerospace Co. and Hanwha Corp., was assigned another role to direct Hanwha Impact’s investment business.

Hanwha Impact is a green energy company under Korea’s No. 7 conglomerate. It has an investment division, which invests mainly in energy transition, digital data and life science technologies, and a business unit, which manufactures purified terephthalic acid (PTA) and builds and operates solar power plants.

BUSINESS TURNAROUND

Kim will be in charge of finding new growth engines for the company, which has been on a downward spiral due to a slump in the local petrochemical industry driven by the fast ascent of Chinese rivals.

PTA is a feedstock for polyethylene terephthalate (PET) polyester packaging, textiles, clothing, plastics, car parts, tires, toys and more.

Hanwha Impact dipped to a loss of 38.5 billion won ($29 million) in 2023 from an operating profit of 44.6 billion won in 2022.

Vice Chairman Kim is credited for turning around other Hanwha companies mostly in eco-friendly energy businesses, such as Hanwha Q Cells Co., Hanwha’s solar panel-manufacturing unit.

Under Kim’s direction, Hanwha Impact is expected to make bold investments in new green energy businesses like hydrogen and liquefied natural gas (LNG). The company is also said to be considering investments in bio startups in the US.

The group also changed CEOs at other core businesses – Hanwha Ocean Co., Hanwha Systems Co., Hanwha Energy Corp. Hanwha Aerospace, Hanwha Momentum Co., Hanwha Power Systems Co. and Hanwha Asset Management.

Of them, Hanwha Aerospace’s CEO Son Jae-il will also head Hanwha Energy.

The mid-year reshuffle is intended to create greater synergy across different sectors, market analysts said.

TIGHTER GRIP

The shakeup is also expected to allow Hanwha Group’s heir apparent Kim Dong-kwan to tighten his grip on group control.

Hanwha Impact is the largest shareholder of Hanwha Energy with a 52.07% stake, and Kim holds 50% of Hanwha Energy, which also controls 9.7% of Hanwha, Hanwha’s holding company at the center of the group ownership.

If Hanwha Impact’s investment in future growth drivers bears fruit under Kim’s leadership, Kim will be able to raise his stake in the holding company.

If the company’s financial soundness improves, Hanwha Impact could even reattempt its initial public offering, forecast market analysts.

Kim was promoted to vice chairman of Hanwha in 2022. His two younger brothers also each control 25% of Hanwha Energy.

Write to Sang Hoon Sung and Hyeon-woo Oh at uphoon@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Hanwha’s Kim Dong-seon to raise his stake in Galleria to 19.86%

Aug 23, 2024 (Gmt+09:00)

-

Hanwha Aerospace to spin off non-core units for defense sector

Aug 14, 2024 (Gmt+09:00)

-

Hanwha Group to expand stock compensation to team chiefs

Jul 18, 2024 (Gmt+09:00)

-

Hanwha's heir apparent promoted as group's vice chair

Aug 29, 2022 (Gmt+09:00)

-

Hanwha heir apparent named senior advisor at US energy investor

Apr 11, 2023 (Gmt+09:00)