E-commerce

Korean e-commerce startup funding sharply drops since 2022

Eun-Yi Ko

Aug 06, 2024 (Gmt+09:00)

South Korean e-commerce companies have seen a sharp decline in series A funding over the past three years amid intensifying competition with Chinese rivals such as AliExpress and Temu, which are rapidly increasing their presence in the Korean market.

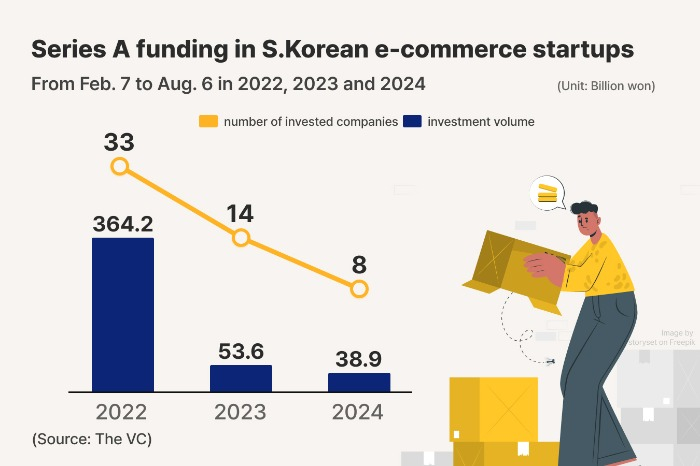

Series A funding in Korean e-commerce platforms from Feb. 7 to Aug. 6 of this year reached 38.9 billion won ($28.3 million), down 27.4% from the same period of last year, according to local venture capital data provider The VC on Tuesday.

Compared with the same period in 2022, the investment plunged to nearly 10% from 364.2 billion won.

The number of invested companies in series A funding in the six-month period fell from 33 in 2022, 14 in 2023 to eight this year.

“Series A funding is a key indicator of an industry’s growth potential. Early stage investing is moving from online platforms to artificial intelligence and deep tech,” the source added.

Meanwhile, series A funding in AI amounted to 131.4 billion won over the past six months, nearly double the 68.7 billion won in the same period last year. Series A investments in robotics, a deep tech sector, increased 70.7% on-year to 19.8 billion won over the same period.

SHRINKING JOBS IN STARTUPS

The net hires of entire Korean startups for a half-year period turned negative for the first time this year since the authorities began to collect the relevant data in 2016, according to the National Pension Service (NPS) and The VC.

Korean startups that NPS had funded hired 45,348 new employees from January to June this year, while 45,452 workers left the companies in the same period.

The NPS-backed domestic startups recruited 115,105 employees in 2022, while 85,501 left such companies in the same year. The number of new hires declined 19.4% on-year in 2023 amid shrinking investments.

Korean startups led job creation for young employees until two years ago. Some 33,000 local ventures and startups, including those yet to be funded, hired 746,000 workers in 2022.

This exceeded 696,000 new hires by the country’s top four conglomerates Samsung, SK, Hyundai Motor and LG Group in the period, according to the Ministry of SMEs and Startups.

Some major startups that used to recruit dozens of employees a year are laying off employees. Online learning platform Class101, real estate platform Zigbang and legal services provider Law&Company have cut back on hiring amid a liquidity drought in the startup industry.

Write to Eun-Yi Ko at koko@hankyung.com

Jihyun Kim edited this article.

More To Read

-

SoftBank-backed Tridge in trouble amid Korean startup doom

Jul 31, 2024 (Gmt+09:00)

-

Korea to build startup campuses in Seoul, Busan by 2026

Jul 25, 2024 (Gmt+09:00)

-

UAE to invest up to $1 bn in S.Korean ventures

May 07, 2024 (Gmt+09:00)

-

Foreign venture funding for Korean startups picks up

Mar 12, 2024 (Gmt+09:00)